As the global economy faces headwinds in 2024, there is a growing concern about the potential resurgence of inflation, despite indications of a contracting money supply and the United States teetering on the brink of a recession. Could inflationary pressures reignite and would this result in a stagflationary scenario?

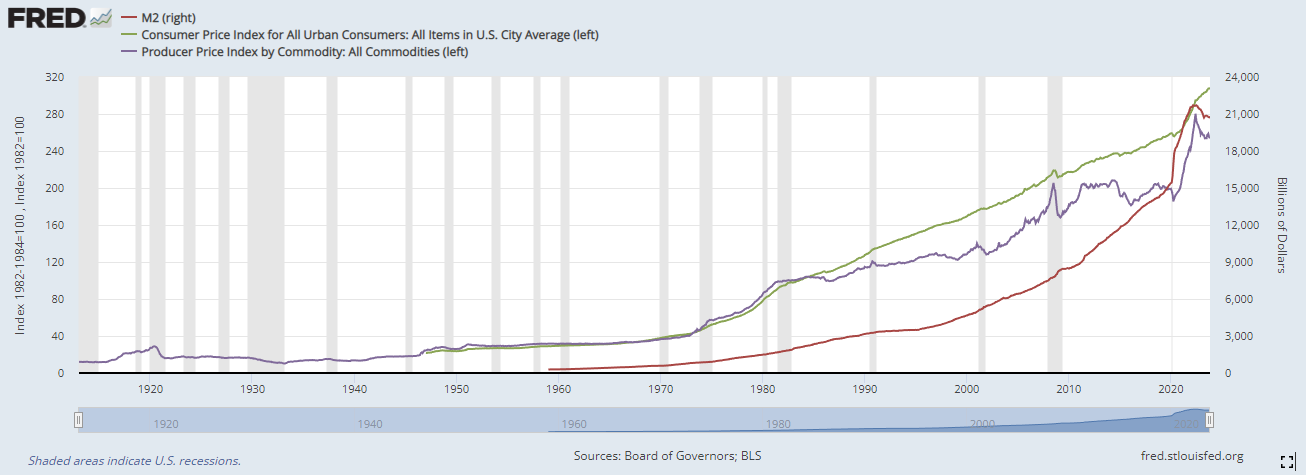

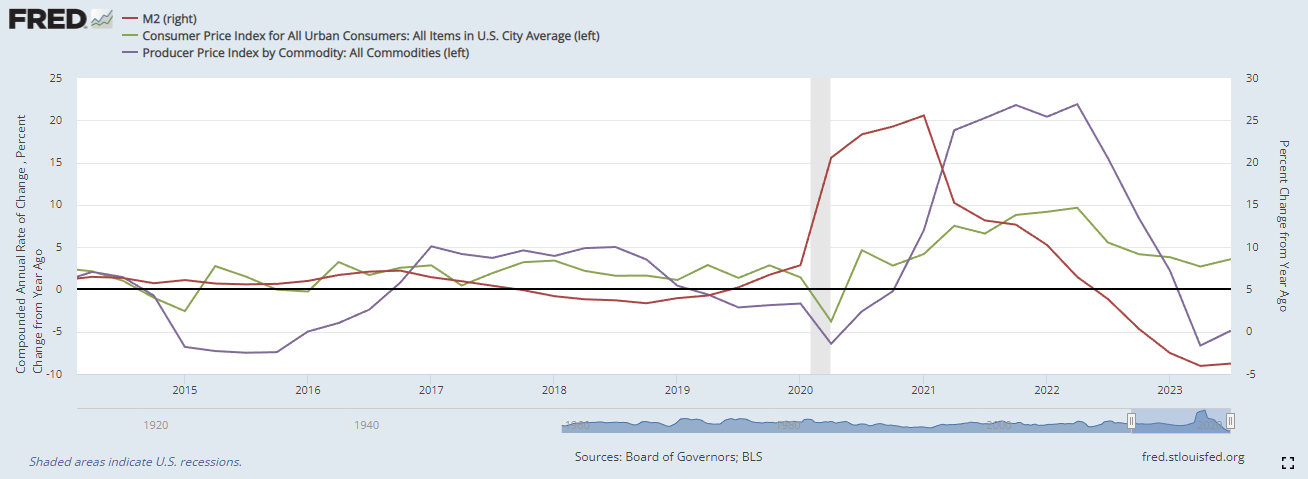

One of the paradoxes facing economists and policymakers is the simultaneous contraction of the money supply and the looming threat of inflation. Traditionally, a shrinking money supply is associated with disinflationary/deflationary pressures. In fact, U.S. headline CPI will likely be sub-2 % in 2024 given the current trend of contracting money supply (1). Trends can change, however. Is there reason to be concerned about inflation rebounding in case of a dovish pivot in monetary policy?

The prospect of a globally synchronized recession adds another layer of complexity. While recessions typically suppress inflation due to weakened consumer demand, the synchronized nature of the downturn could create supply-side challenges. If multiple economies simultaneously contract, the global supply chain may experience further disruptions, possibly driving up prices.

The response of central banks to economic challenges plays a pivotal role. In an attempt to mitigate the effects of a recession, central banks may adopt expansionary monetary policies, injecting liquidity into the system. If these measures are not carefully calibrated, they could inadvertently fuel inflation.

The “Monetarist” School of Economics, famously associated with Milton Friedman, would argue for the importance of monetary aggregates in economic activity. Monetarism’s classic claim is that growth in some monetary aggregate drives inflation.

The 26.9% rate of YoY growth in Feb 2021 exceeds the rates of growth during the QE programs (post-GFC) or the inflations of the 1970s and 1980s. The current negative rates of growth are also unprecedented. CPI and PPI followed M2 growth up and followed it coming back down.

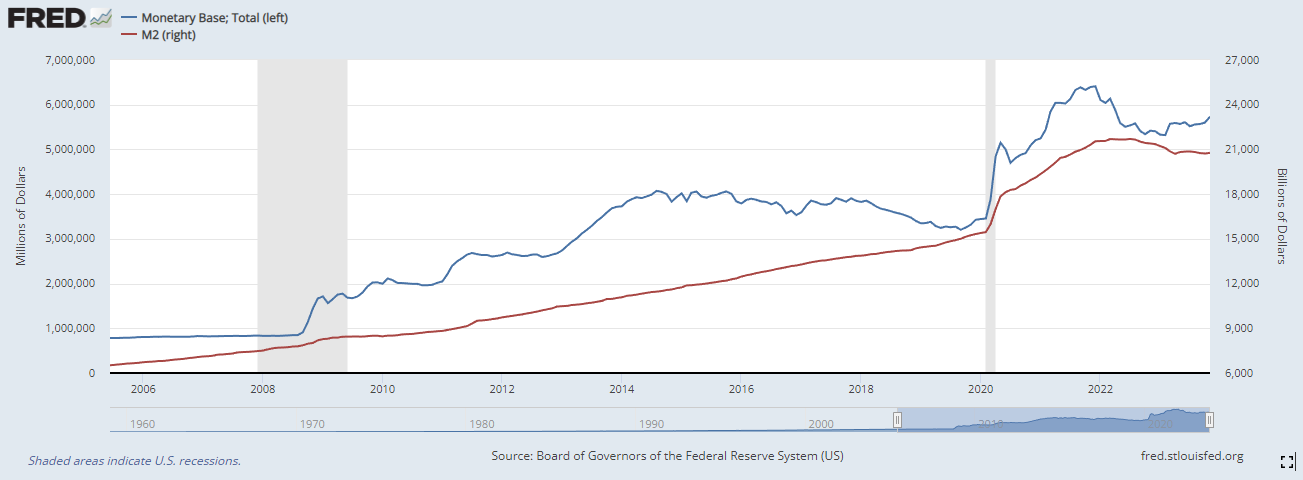

The growth in the monetary base in 2008-15 did not spark unusual growth in M2 or inflation during that period. Probably due to banks essentially swapping bonds for reserves held at the Federal Reserve. So, why did the growth in the monetary base cause inflation post-pandemic?

Money can be created in two ways; the traditional means via commercial bank lending or direct monetization of newly issued federal debt. This distinction is crucial. Up until recently, it has been the commercial banks that have been able to claim sole responsibility for the growth in the broad money supply.

The notion that quantitative easing (QE) conducted by itself is money creation is false. The Federal Reserve and other central banks can influence the base money supply (M0), but not the broad money supply.

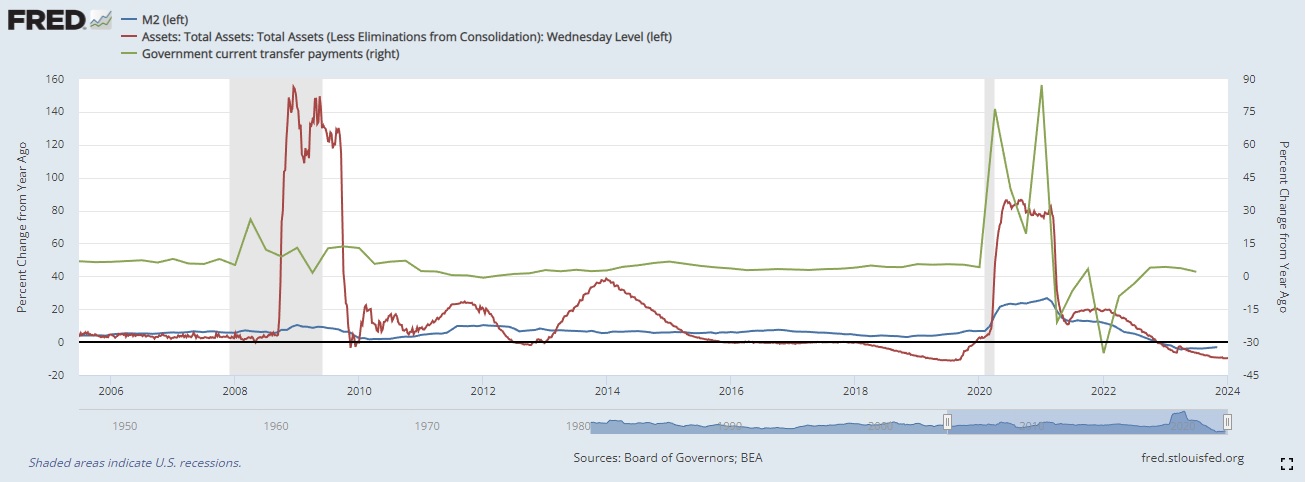

If central banks and governments work together, however, they can rapidly increase the base money supply and the broad money supply. When a central bank directly monetizes the federal deficit using freshly printed currency, then it is in the business of creating money. We can see this relationship in the chart below.

The combination of the Treasury Department and the Fed working together, with the Treasury Department sending checks out into the broad money supply and the Fed creating new base money to buy the bonds associated with that spending (rather than extracting that money from real lenders buying the bonds with existing money), outright increases the broad money supply.

Commercial banks create money via fractional reserve banking when lending occurs between said banks and consumers and businesses. Commercial banks likely wouldn’t increase lending in case of a recession, however. We have just described a scenario in which it wouldn’t be necessary for commercial banks to increase lending for the money supply to expand and inflation to rebound. The government running large deficits, financed by the central bank doing quantitative easing would do the trick.

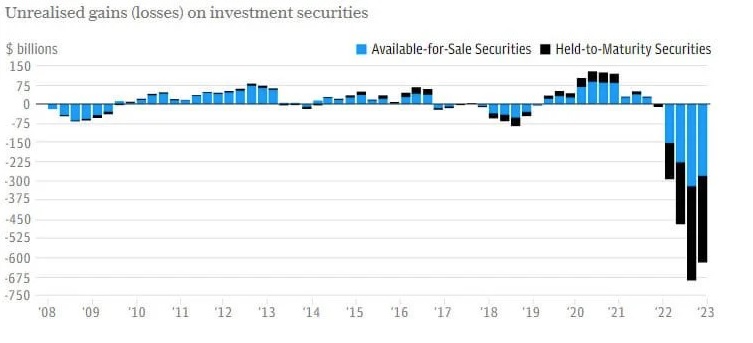

What would cause governments and central banks to stimulate in the same manner we last saw post-pandemic in 2020 and 2021? Perhaps a dovish pivot is forced due to e.g. financial stability. Half of America’s banks are potentially insolvent. The U.S. banking system’s market value of assets is $2.2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity.

We then have potential spill-over effects from the Chinese real-estate sector in free-fall, geopolitics taking a turn for the worse, and many potential adverse factors weighing heavy on monetary policy across the world.

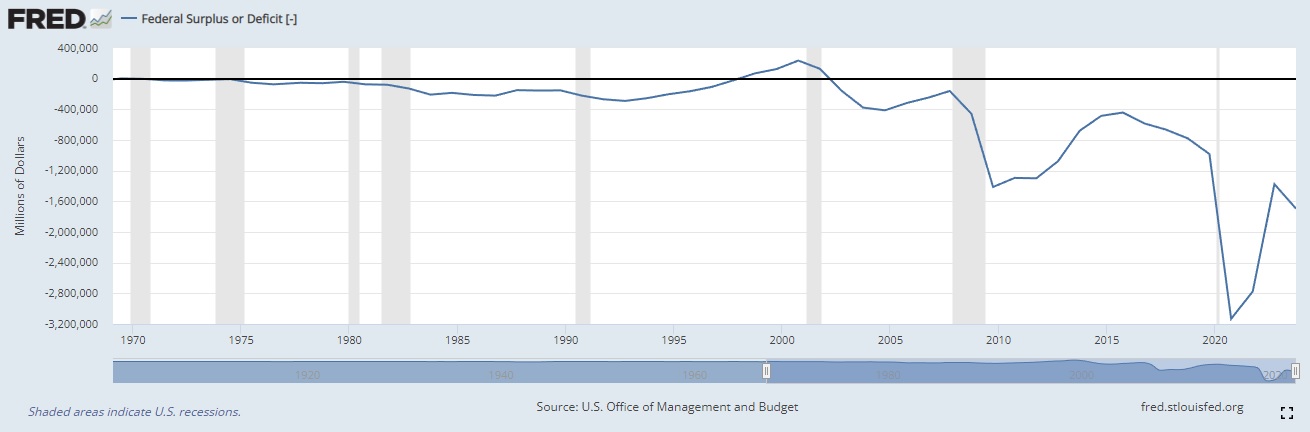

Another factor is the looming recession. Fiscal deficits are guaranteed and likely to worsen due to automatic stabilizers kicking in. Even with rates coming down, the amount of government debt issued needs market demand to stay high – if not – central banks are lenders of last resort. Given what we have seen recently in terms of fiscal deficits in the U.S., expecting anything but deficits going forward would appear very unlikely.

Treasury market dysfunction

Concerns about the rising federal deficit have been rattling bond investors for a while now, and rising interest rates have also meant that the government has to pay more and more to service that debt, too. In August, Fitch Ratings downgraded the US government’s credit rating, citing “steady deterioration in standards of governance” on “fiscal and debt matters.” If the deficit doesn’t shrink, demand could weaken, perhaps even to the point of treasury market dysfunction. The Federal Reserve would have to step in, restarting QE and perhaps YCC, the alternative is to let the treasury market collapse and that is simply not viable.

The role of the Treasury market as backbone of the entire financial system cannot be overstated. As evidenced in March-2020, Treasury market dysfunction would rapidly propagate into other markets, harming American consumers, businesses, and municipalities alike. Trading in and financing of U.S. Treasury securities would be called into question, leaving the market without a benchmark pricing curve and causing investors to pull back from fixed income and equity markets. Market intermediaries would reduce liquidity provision amidst increasing volatility, heightened operational risks, and concerns about credit worthiness and collateral eligibility. The validity of Treasuries as eligible collateral for margin would be called into question, with devastating consequences for interest rate derivative, commodity, and mortgage markets.

– Treasury Borrowing Advisory Committee

Stagflation: A Looming Threat?

Stagflation, a situation characterized by stagnant economic growth and high inflation, becomes a potential concern if the factors mentioned above converge. The simultaneous occurrence of a recession and inflation puts policymakers in a delicate position, as conventional monetary and fiscal tools may be insufficient or counterproductive.

Central banks facing stagflation are constrained in their ability to respond. Raising interest rates to combat inflation could further dampen economic activity, exacerbating the recessionary pressures. On the other hand, keeping rates low to stimulate growth might aggravate inflation.

Governments may also find themselves in a dilemma. Implementing expansionary fiscal policies to stimulate the economy can add fuel to the inflationary fire, while austerity measures to control inflation may worsen the recessionary conditions.

Conclusion:

As we navigate the economic landscape of 2024, the risk of inflation rebounding in the face of a contracting money supply and a potential global recession cannot be ignored. Supply chain disruptions, global economic interdependence, and specifically the policy responses of central banks will play pivotal roles in determining the trajectory of inflation. Policymakers must tread carefully to avoid the pitfalls of stagflation, employing nuanced strategies that address both inflationary and recessionary pressures. In such a complex environment, a proactive and adaptive approach will be essential to maintaining economic stability and fostering sustainable growth.

References:

1. Steve H. Hanke, Zixiang Ma, Ruiyuan Cheng, “On the Quantity Theory of Money: Some Monetary Facts”